How Social Media facilitates socially-driven treat management dynamics

When the nation’s mortgage companies are “on the verge of collapse” [WSJ, July 13, 08] that’s a big reason to get worried.

But while Social Media resonance on the crisis spiked tremendously (as one would expect) it doesn’t spell panic and doesn’t call for consumer emergency action (ignoring ongoing crisis-talk on the agenda-setting mass media).

1st2c monitored the consumer response to the crisis on Social Media, uncovering key insights on the dynamics of Social Media in facilitating threat management “by the people – for the people”.

12 Trillion reasons to worry

When the news hit the market the American publishes was pretty much pepped up to worry.

The media has been talking economic doom for a long time now.

Recession, depression, downturn, rocketing interest rates, hiking living costs, plummeting housing market are only few of the labels spelled out by news and commentaries.

It’s not surprising that these are hot topics in consumers dialog on Internet’s Social Media space.

But the Freddie Mac and Fannie Mae crisis was supposed to take the threat a notch higher. After all, these giants touch more than half of the nation’s $12 Trillion mortgages!

According to publications these banks may default on their huge debt, government guarantees will effectively double the public debt, and that their difficulties may damage economies worldwide since the securities of Fannie and Freddie are held by numerous overseas financial institutions, central banks and investors.

But public confidence may be even more undermined by immediate implications on individual consumers.

If the two banks are unable to borrow, they will not be able to buy mortgages from commercial lenders. In turn, that would make it more expensive and difficult, if not impossible, for home buyers to obtain credit, freezing the United States housing market (NYTimes, July 11, 2008).

It was only natural for consumers to see the unfolding event in terms of crisis.

In the age of the networked market it was only natural for consumers to share “intelligence” and minds, to seek peer advice and support and perhaps also to mobilize to act upon the crisis.

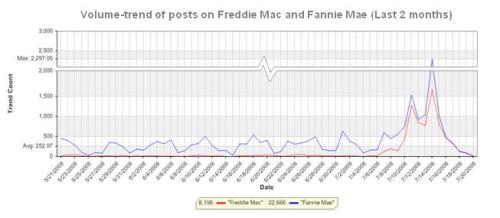

As 1st2c tracking system shows, the event did trigger a surge in volume of consumer conversations across Social Media platforms.

But was it panic talk?

What me worry?

Analysis of online dialog about the mortgage giant crisis discovered interesting insights:

· Most of the talk was on THEM (the banks, government, fed) and not on ME

· Much of the talk came from interest groups rather than “concerned citizen”

– Political activists (mainly non-republicans…)

– Financial and technology investors

– Financial mavens

– And interestingly also automobile fan communities….

· Talk tended to focus on the immediate problem rather than on the broad economic implications

· Talk on imminent crisis was scarce

· Call for action was scarce

Too big to worry

A Bloomberg TV commentary from Jul 11 2008 quoted congressional leads from both parties saying that Freddie Mach and Fannie Mae are “too big for the government to let them fail” (YouTube).

This assumption, though sometimes challenged (“… and too big to be bailed out”), is the underlying sentiment among the networked public.

In many respects, Social Media played a balancing role to the mass media, in shaping public understanding and reaction to the mortgage bank crisis.

Social media did not simply play along with corporate media.

When consumers talked to other consumers they essentially helped frame the crisis as “not on our turf”. Consumer dialog identified the threat not on a personal level but a systemic level. The magnitude of threat was discussed in terms of passing the threshold of uncertainty about the imminence government intervention.

So while the media continued to preoccupy with whom and what can curb the threat, Social Media already echoed with a clearer notion of “beyond the worry threshold”.

Social Media as the peoples’ threat management mechanism

Market dynamics may change and future developments might alter public response to the unfolding economic developments. But this situation analysis does provide deeper insights into how Social Media helps shape public perceptions and behavior.

The Freddie Mac and Fannie Mae case study highlights the fact that Social Media is a socially-driven platform for identifying and meeting of unmet needs.

In this case, the need was for threat relevance understanding as aspect of threat management.

Experience shows that the Social Media helps people “calibrate” mindsets on a disregard-involvement-action continuum based on 3 key parameters:

· Relevance

· Immediacy

· Gravity

In this case, consumer used Social Media to balance and control rather than stir and demonize.

It would also be worthwhile for marketers to take note of the anthropological aspect of the dynamics of social influence to understand what social environments and mechanisms facilitate and energize the “Social ripple of influence”.

1st2c in a nutshell

1st2c (www.1st2c.com) is the home of Online Strategizing Research©.

1st2c specialized in the most comprehensive data-to-strategy methodology in the networked market.

1st2c monitors all major Social Media platforms and mines consumer dialog and interaction for actionable insights and opportunities.

1st2c works with Fortune 500 companies on adding new dimensions to overall marketing strategy and on monitoring and engaging the networked market.

Ofer Friedman

Chief Research & Client Officer

1st2c